The Ultimate Guide to DWAC Stock: Understanding the Buzz and Investment Potential

DWAC stock has garnered significant attention in the financial markets in recent years, primarily due to its ties to high-profile figures and status as a Special Purpose Acquisition Company (SPAC). This article delves deep into the nuances of DWAC stock, including its formation, controversy, financial potential, and the best strategies for investors. Whether you’re an experienced trader or a beginner looking to understand the buzz around DWAC, this guide provides a comprehensive view of everything you need to know.

What is DWAC Stock?

Overview of Digital World Acquisition Corp. (DWAC)

Digital World Acquisition Corp. (DWAC) is an SPAC, a type of company created solely to acquire or merge with an existing private company to take it public. DWAC was formed in 2020, and its goal was to find a suitable merger target within the technology and media sectors. Unlike traditional IPOs, SPACs offer companies a faster and often less complicated way to enter the public markets.

In 2021, DWAC revealed its plans to merge with Trump Media & Technology Group (TMTG), the parent company of Truth Social, a social media platform launched by former U.S. President Donald Trump. This merger drew considerable attention, with DWAC stock skyrocketing following the announcement. The deal was positioned as an attempt to disrupt the social media industry, particularly as an alternative to platforms like Twitter and Facebook, which Trump and his supporters had often criticized for censorship.

Understanding the TMTG Merger

The merger between DWAC and TMTG is at the heart of DWAC’s stock allure. TMTG’s mission is to challenge the dominance of major social media giants by creating a platform that aligns with more conservative values. Truth Social, TMTG’s flagship product, aims to attract users who feel alienated by the policies of traditional platforms.

For DWAC, this merger is its ticket to offering investors a stake in a potentially high-growth media company. While Truth Social has faced significant criticism for limited user growth and technical challenges, its connection to a polarizing figure like Donald Trump has ensured substantial media coverage and investor attention. The completion of the merger is expected to pave the way for DWAC to enter the media and tech space with a robust, high-profile asset in hand.

Why is DWAC Stock So Controversial?

Political and Social Implications

One of the main reasons for the controversy surrounding DWAC stock is its close ties to Donald Trump. Trump’s role in TMTG and the creation of Truth Social has attracted passionate supporters and vocal critics. Supporters argue that the company represents a chance to break free from the perceived censorship on traditional social media platforms, especially for conservative voices. On the other hand, critics argue that the entire venture is politically motivated and could face significant challenges in scaling, especially when it comes to attracting users who are not already supporters of Trump’s political ideology.

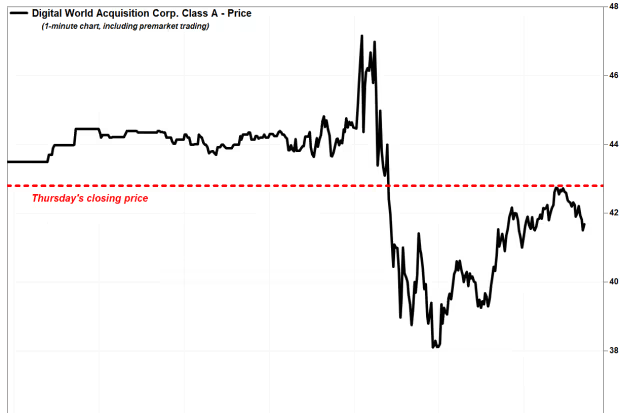

The political nature of DWAC stock has made it a volatile investment. Market participants, particularly retail investors, are often swayed by political rhetoric and social media influence, which can lead to erratic price movements. DWAC stock has become a topic of discussion in online forums and among retail investors, making it subject to rapid speculation and price swings.

Legal and Regulatory Challenges

DWAC has also faced significant legal and regulatory scrutiny. The Securities and Exchange Commission (SEC) has been investigating the merger and its related dealings, especially the timing and disclosures surrounding the deal. These investigations have shadowed DWAC’s potential, with concerns about insider trading and unfair market manipulation emerging. While no charges have been filed, the ongoing legal uncertainty has raised questions about DWAC’s long-term viability as an investment.

The legal challenges are particularly significant because they could delay or even prevent the merger. Any setback in the merger process would likely negatively impact DWAC’s stock price, making it a risky bet for investors.

Financial Analysis of DWAC Stock

Revenue Potential and Business Model

The revenue model for DWAC stock hinges mainly on the success of Truth Social and TMTG’s broader strategy. Truth Social operates in a highly competitive market, with established platforms like Twitter, Facebook, and Instagram dominating the social media space. However, TMTG’s unique selling proposition lies in its claim of free speech and minimal censorship, which resonates with specific user groups, mainly conservatives and former Trump supporters.

In addition to Truth Social, TMTG plans to expand its offerings into other media ventures, including podcasts, television, and perhaps even new social media platforms. However, the path to profitability for these ventures is uncertain. Truth Social has faced challenges in user acquisition and platform stability, and monetization efforts are still in the early stages.

The financial risk for investors is substantial. If Truth Social fails to attract a large user base or encounters further technical difficulties, DWAC’s value could decline dramatically. Investors must weigh the potential for high returns against the substantial risks of such a high-profile but uncertain venture.

Risk Factors for Investors

Investing in DWAC stock comes with several risk factors that investors must consider before deciding. These include market volatility, political polarization, and legal risks. The stock has been highly susceptible to market sentiment, meaning that sudden changes in public opinion or political events can cause significant price fluctuations.

Another risk is the lack of a proven business model. While TMTG has high aspirations, whether Truth Social can maintain user engagement and generate meaningful revenue remains to be seen. If the platform fails to achieve long-term growth, DWAC’s stock may struggle to recover, leaving investors at a loss.

How to Invest in DWAC Stock

Steps to Buy DWAC Stock

For investors interested in buying DWAC stock, the process is relatively simple. You can purchase DWAC shares through major brokerage platforms such as Robinhood, E*TRADE, TD Ameritrade, and Fidelity. All you need to do is set up an account, deposit funds, and order DWAC stock, just like any other publicly traded company.

It’s important to note that DWAC is a highly speculative stock, so investing in it carries a significant level of risk. Be sure to do thorough research and, if necessary, consult with a financial advisor before purchasing shares.

Strategies for Investors: Long-Term vs. Short-Term

Investors in DWAC stock must decide whether they want to adopt a long-term or short-term strategy. Those seeking quick profits may consider buying and selling based on short-term news or price movements. This strategy often involves watching for events like merger announcements, legal settlements, or key political developments that could affect DWAC’s stock price.

On the other hand, long-term investors may bet on TMTG’s future success and its ability to disrupt the social media industry. However, this strategy requires a belief in Truth Social’s and TMTG’s broader media ventures’ long-term potential.

Alternatives to DWAC Investment

For those seeking a less volatile investment in the media and tech space, there are several alternatives to DWAC. Established media companies like Meta Platforms (formerly Facebook), Twitter, and Alphabet (Google) offer more stability and proven business models. Additionally, other SPACs in the tech sector may present lower-risk opportunities.

Conclusion

DWAC stock has become one of the most talked-about investments in recent years, mainly due to its connection to Trump and the media platform Truth Social. While there are substantial opportunities for growth, mostly if the merger with TMTG succeeds, significant risks are involved, including market volatility, legal scrutiny, and uncertain revenue streams. Investors interested in DWAC stock should carefully weigh these risks and consider whether the potential rewards outweigh the downsides. Whether looking for short-term gains or a long-term bet on a new media venture, DWAC presents both high risk and high potential.

FAQs

- What is DWAC stock, and why is it important?

- DWAC is a SPAC that aims to merge with TMTG, creating opportunities in the media and tech sectors.

- What does the merger between DWAC and TMTG mean for investors?

- The merger could result in a new media platform, Truth Social, becoming publicly traded, presenting opportunities and risks for investors.

- Why is DWAC stock so volatile?

- Political factors, speculation, and regulatory challenges affect DWAC’s price swings.

- How can I buy DWAC stock?

- DWAC shares can be purchased through major brokerage platforms like Robinhood, E*TRADE, and Fidelity.

- What are the risks of investing in DWAC stock?

- Key risks include market volatility, legal scrutiny, and the uncertain success of Truth Social and other TMTG ventures.

You May Also Read: https://topblogbuz.com/nvda-yahoo-finance/